This is an AI translated post.

Select Language

Summarized by durumis AI

- Charlie Munger was an American businessman and investor known as the mentor of Warren Buffett, who passed away at the age of 99 on November 28, 2023.

- He served as a director on the boards of Wesco Financial and Costco and as vice chairman of Berkshire Hathaway, where he was respected as a master of value investing alongside Warren Buffett.

- Munger left behind various famous quotes on investment, life, and success, and his insights continue to inspire many people today.

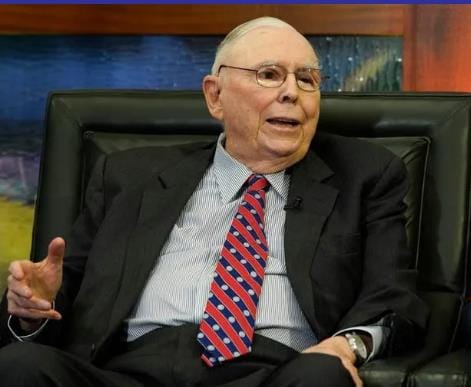

Charlie Munger

Charlie Munger (January 1, 1924 – November 28, 2023)

An American lawyer, businessman, and investor. He is also known as Warren Buffett's mentor.

He served as a director of Wesco Financial and Costco, and joined Berkshire Hathaway, serving as vice chairman. He was a right-hand man of Warren Buffett, a giant investor. Born in 1924, he was six years older than Buffett, but he was a close friend and business partner, often accompanying him to public events. Although he was somewhat overshadowed by Buffett's fame, he was a highly respected investor, known for his value investing. Even in his late 90s in the 2010s, he continued to participate in public activities, including attending Berkshire Hathaway shareholder meetings with Buffett.

He passed away on November 28, 2023, from illness. He was 99 years old. Considering that he was born on January 1, 1924, he would have celebrated his 100th birthday at the beginning of the new year 2024, but he passed away just a month before his birthday.

○ The stock market is a place that transfers money from the active to the patient.

○ Investing is about finding a few great companies and then sitting on your backside and doing nothing.

○ Copying the crowd is a sure way to regress to the mean.

○ Success takes two things: first, you have to be right; and second, you have to be wrong in a big way.

○ The first rule of fishing is to know where the fish are, and the second rule is never to forget the first rule.

○ Envy is a very foolish thing. It’s a 100% guaranteed failure.

○ Life is a series of tradeoffs. You should marry the best person you can possibly get along with for the rest of your life. Investing is very much the same process.

○ In life, you will get kicked in the ass, kicked in the ass terribly, and kicked in the ass unfairly. All of life’s mistakes are opportunities to learn something, and our job is not to become paralyzed with self-pity but to use the awful kick in the ass constructively.

○ If you don’t learn, you’re like a one-legged man in an ass-kicking contest. You’re not going to do well.